Learn how to determine the worth of your coins and know about the factors that influence collectible coin values.

“How much is my coin worth”, you ask?

Determining coin values is essential both to advanced numismatists and beginners in coin collecting. And learning coin pricing is important not only to guide you in buying coins at the right price, but also in selling coins or investing on coins in the future.

Coin appraisal services

Coin appraisal is the process of determining values of coins. It is performed or practiced only by professional coin appraisers because sufficient amount of experience, knowledge, and skills is required to come up with the most accurate coin price.

Appraisal services are generally provided for a fee. Some coin buyers and dealers from the net also offer free coin pricing online but only to collectors who are interested of selling the appraised coin. These services can be found throughout the country. Many historical cities provide great opportunities to find old and sometimes rare coins.

But before going to an expert appraiser, it is advised that you also learn the basics in coin pricing and you know about coin price ranges. This way, you will have an idea whether the appraised value made by the consulted professional is realistic or correct. In other words, you will be protected from the risk of fraudulent coin appraisals.

Factors that influence the worth of your coins

Collectible coin values generally depend on the law of supply and demand – coin prices go up when supply is low and demand from numismatists is high. But in circumstances that supply is high but the interest of collectors for the coins is low, coin values consequently decline.

The price also depends on how much a collector is willing to pay for a collectible coin. Take for example in coin auctions where famous rare coins reach millions of dollars in market value because interested collectors offer such price.

The demand and the willingness of a buyer to pay for a coin are influenced by the following factors.

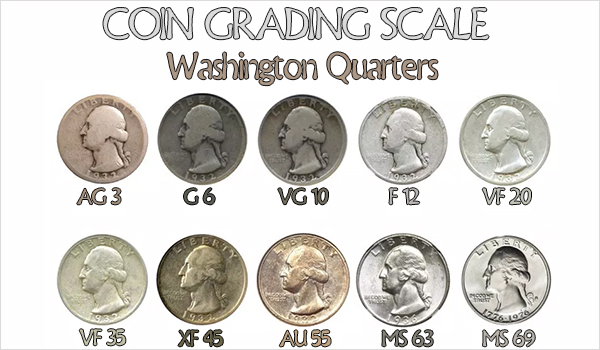

1.) Condition of the coin or coin grade

Coin grading is the process of evaluating the state or condition of a coin. In numismatics, coin grading is considered as partly a science and partly an art. It requires the right combination of knowledge, skill, and instincts for a grader to come up with the most realistic coin grade.

Most coin graders and authenticators use the 70-point Sheldon Scale as the standard grading system with 1 or P1 as the lowest and Perfect Mint State 70 as the highest. Examples of reputable coin grading service providers are the Professional Coin Grading Services and Numismatic Guaranty Corporation.

What to look into when evaluating a coin:

• Coin marks

Look for “hairlines” (tiny hardly visible lines), scratches, and other imperfections on the coin. In a US coin, the Liberty’s cheek is a grade-sensitive area (a section on the coin where marks are easily noticeable than others). Marks found on grade-sensitive areas of the coin are more damaging to the coin’s worth than the scratches found on non grade-sensitive parts.

• Coin luster

Texture and luster may vary in different kinds of coins. A business strike (coin struck as regular money or currency) will be graded Mint State 65 or higher if it had vibrant surface and excellent polish.

• The coin strike

Weak coin strikes result to hardly visible coin designs. This may result to a lower coin grade but it does not significantly affect the coin’s overall quality and eye appeal.

• Over-all appeal

Lastly, to determine the grade of the coin, the over-all eye appeal must be taken consideration. If the coin looks ugly to you even without further examination to its details, then it may be ugly to the eyes of other collectors as well. Ugly coins are cheap if they are worth anything at all.

2.) Rarity of the coin

It is a general truth that rare coins are valuable. The most expensive coin in the world – the 1933 Saint Gaudens Double Eagle coin – was worth more than $ 7 million in 2002. There is only one known legitimate sample or specimen of this coin that exists today.

Other very valuable and famous rare coins were the Australian Proof 1930 Penny worth more than a million dollars and the 1894-S Barber Dime which was sold for almost 2 million dollars. Both of these coins are very scarce with only 6 and 10 samples known to exist today, respectively.

3.) Age of the coin

The rarity and age of the coin are often associated with each other. Generally speaking, old coins are rare coins. Coins can be lost in commerce in time.

And since old coins can never be minted again at present (unless they are replica coins), then there will never be an increase of supply for old coins.

It must be clear, however, that not all old coins are rare coins and not all values of old coins are high.

For example, during the early times, Romans minted excessive numbers of coins for their currency.

Until today, numerous ancient Roman coins are available in the market and many of them are priced less than a hundred dollars.

4.) Bullion value

The coin’s bullion value is the commercial price of the metal a coin contains. The changes in bullion value may affect the actual market price of a coin. For instance, the price of a silver coin will increase if its silver coin melt value is also high. The case is so with gold coins.

For example, the gold 1933 Saint Gaudens Double Eagle having a face value of $20 and has a gold value worth $873.26 can be bought for $7.5 million during 2002.

If its gold value will increase to $900 this year, the current market price of the Saint Gaudens may also increase to more than its 2002 price of $7.5 million.

Note: The amounts stated in the example above are for illustration purposes only.

5.) Historical significance

Aside from rarity and age, the most expensive collectable coins in the world are also valuable because of their historical significance or background.

Each of the pieces has a lot of stories to tell about why or how it was minted.

For example is the 1804 Silver Dollar. There were about 20,000 pieces of Silver Dollar minted in 1804 but all of these were marked with the 1803 mint date.

The first Silver Dollars with the 1804 mark were only struck in 1834 and were given as gifts from US to the King of Siam (now Thailand).

Other specimens of the 1804 Silver Dollars were minted illegally somewhere between 1858 and 1860.

6.) Presence of coin toning or discoloration

Coin toning is the discoloration of the coin through time. This usually and naturally occurs on silver and copper coins.

While some toned coins can end up looking ugly and deteriorated, a coin could also change in color beautifully as with rainbow toned silver coins.

This type of coin toning becomes very appealing to many expert numismatists, thus will make the coin valuable in the market.

Some collectors would have their coins artificially toned to take advantage of the increase in the value of toned coins.

7.) The economic condition

It is often a debate whether or not an unstable economy adversely affects the coin market.

Some collectors believe that selling coins during an economic downturn is not a good idea because prices of collectible coins go down. Thus, for coin buyers, purchasing coins during recession is ideal.

It is also said that since people tend to lose purchasing power during a decline in the economy, buying coins for a collection will not be a priority.

Other numismatists say that coins, especially bullion coins, have inherent or intrinsic value which means that the value of coins does not rely on the condition of the economy. Thus, in the midst of fiscal crisis, the collectible coin values remain stable.

How much is my coin worth?

Knowing the factors affecting prices of coins is just one step in determining coin values; it can be impossible to estimate a specific amount.

Compare collectible coin values from various coin price guides both online or in magazines (and other printed coin resources). By doing this you can come up with a price range. Just remember that coin prices are highly volatile, they can change quickly overnight.

Getting the coin appraised

To determine the value of a coin accurately, collectors and investors often consult price guides, auction records, and professional appraisers. Online resources, coin dealers, and numismatic associations can also provide valuable information and assistance in assessing a coin’s worth. Keep in mind that coin values can vary, so it is essential to consider multiple sources and factors when determining the value of a specific coin.

Leave a Reply