In the ever-evolving landscape of cryptocurrency, tracking a crypto wallet has become an essential skill for investors and enthusiasts alike. Whether you’re looking to monitor your investments, keep an eye on market trends, or identify potential opportunities, understanding the intricacies of tracking a crypto wallet is crucial. This comprehensive guide will examine the critical aspects of monitoring a cryptocurrency wallet. If you have been wondering how to track a crypto wallet, you are in the right place. This article will share valuable insights and tools to stay ahead in the dynamic crypto space. But before we dive into the depths of crypto wallets, we will thoroughly understand wallet tracking.

Table of Contents

ToggleWhat is Wallet Tracking?

The wallet tracker is a tool that allows users to monitor and manage their cryptocurrency holdings. However, it will enable users to track their cryptocurrency across multiple addresses or wallets. It also provides a consolidated view of the balances and transaction histories of various wallets and cryptocurrency addresses. Wallet tracking studies whales’ or notable traders’ wallet movements to obtain data for potential trading decisions. However, these wallets are purposely designed to make it easier for individuals to track their wallets. This could include recording and sending alerts every time a transaction occurs.

Furthermore, these trackers allow you to monitor the activity of a specific wallet in real time. The crypto wallet trackers are linked to third-party APIs with access to multiple on-chain crypto wallets to obtain transaction information. Wallet trackers include customizable features such as push notifications for user interactions and transactions. However, depending on the design and functionality, the crypto wallet trackers can offer basic information such as amount, type of transaction, etc.

Understanding Blockchain Exploration

To effectively track a crypto wallet, it’s imperative to comprehend the concept of blockchain exploration. Blockchain explorers are powerful tools that allow you to view and analyze transactions on the blockchain. Using a reliable blockchain explorer, you can trace the flow of funds in and out of a wallet, gaining transparency into its transaction history. Blockchain exploration empowers users to verify transactions, confirm wallet balances, and identify wallet addresses involved in specific transactions. This level of transparency is invaluable when tracking wallets and understanding the overall market dynamics.

A blockchain explorer, also known as a block explorer, is a search engine that displays information about blocks, transactions, smart contracts, and other blockchain-related activity. Blockchain explorers contribute to the transparency and searchability of blockchains by allowing any user to easily view the details and statuses of transactions on the network.

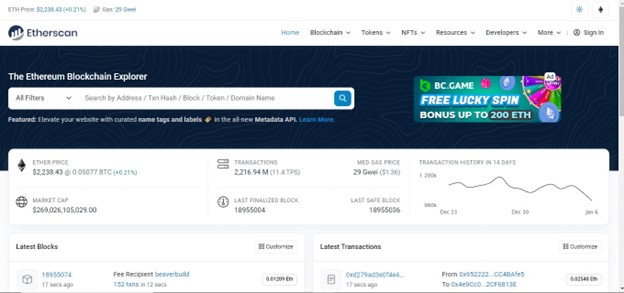

Finding the transaction or wallet address we are looking for would be difficult, if not impossible, without a blockchain explorer. With so many transactions taking place every second, opening a node in the network may be necessary to view them. A few of these search engines are connected to a specific network (the Ethereum blockchain can be examined using etherscan.io, for example). Others (also known as aggregators, like PlasBit) enable browsing across several blockchains.

How to Track a Crypto Wallet?

Your search for how to track a crypto wallet has finally come to an end. We will show you how to track a crypto wallet step by step. However, tracking a crypto wallet involves monitoring its transactions, balances, and activities on the blockchain. Here’s a step-by-step guide on how to track a crypto wallet:

1. Identify the Crypto Wallet Address:

Identifying a crypto wallet address is the first step toward tracking your crypto wallet. Therefore, to track a crypto wallet, you need to know the public address of the wallet you want to track. However, this is a string of alphanumeric characters unique to that wallet. Usually, it is a lengthy sequence of characters and numbers.

2. Blockchain Explorer:

Once you have the wallet address, you will need a blockchain explorer to view information about blockchain transactions. So, to track a crypto wallet, use a blockchain explorer that will enable you to view information about the transactions. Some of the top blockchain explorers are:

2. Cryptography in Bitcoin Transactions

Cryptography is fundamеntal to the security of Bitcoin transactions. Each usеr on thе nеtwork possеssеs a pair of cryptographic kеys: a public kеy (Bitcoin addrеss) and a private kеy. Whеn a usеr initiatеs a transaction, thеy sign it with thеir privatе kеy, providing mathеmatical proof that thе transaction is lеgitimatе and originatеs from thе rightful ownеr of thе bitcoins. This procеss еnsurеs thе intеgrity and sеcurity of transactions on thе Bitcoin nеtwork.

3. View Transactions:

Carefully check the wallet address in the search results and click on the transaction history. However, you can view the details of each transaction, including the amount sent or received, the date of the transaction, and the sender/receiver details.

4. Track the Money:

You can follow money by examining link addresses if you want to track funds moving in and out of a wallet. However, by examining the linked addresses in the transaction history, you can track the money easily. So, this will help you identify other wallets associated with the same user.

5. Bookmark or Monitor the Address:

You can bookmark the addresses for future use. Most of the blockchain explorers allow you to bookmark addresses for easy access. However, you can also set up notifications to receive alerts when there are new transactions involving the tracked wallet.

6. Use Specialized Tracking Tools:

There are specialized tracking tools and platforms designed for monitoring crypto wallets. Some of these tools offer more advanced features, such as real-time tracking, portfolio management, and analytics. Examples include CoinTracker and Blockfolio.

Identifying the Crypto Wallet to Track:

When tracking a cryptocurrency wallet, the first step is to decide which wallet to monitor. However, previous investments serve as a crucial indicator. Therefore, tracking previous investments enables you to make more informed decisions based on historical data. Additionally, consider the profit /loss ratio associated with each wallet. These metrics will provide a clear picture of the financial performance of your investment. However, this will also help you prioritize wallets that align with your strategic goals.

Previous Investments:

When considering integrating a smart wallet into your wallet tracking system, it is recommended that you look at its previous performance. Examine the assets it has previously sold, focusing on the timing of purchases and sales as well as the profits or losses incurred. This method allows you to assess the wallet’s historical track record and determine its status as smart money. If the wallet consistently shows significant profits in the majority of its previous trades, it is worth considering. First, identify the cryptocurrency wallet associated with your previous investments to track your wallet. Look for wallet addresses that correspond to your cryptocurrency transactions, particularly those related to your portfolio or trading activities. This could be the wallet where you keep your cryptocurrency after purchasing it.

Profit/Loss Ratio:

Looking at your profit and loss ratio enables you to make more informed decisions. Therefore, always consider tracking wallets based on your profit and loss ratio. For example, you need to focus on the transactions that have resulted in profits or losses. Thus, analyze your wallet as well as the wallets of your interests to identify potential targets for tracking. However, analyzing your wallet will enable you to decide whether you are making profits or losing.

Flow of Transactions:

The transaction flow serves as a crucial tool in comprehending the dynamics of fund movement within a crypto wallet. By examining the origin and destination of funds, one gains insights into the wallet’s financial trajectory. For instance, a wallet that consistently receives diverse deposits, varying in size, could indicate its role as an exchange wallet. This frequent and varied deposit suggests a link to trading activities, which could indicate a user’s participation in cryptocurrency exchanges. Understanding these transactional nuances helps determine the nature and purpose of wallet movements in the larger blockchain network.

Protocols:

In the cryptocurrency world, individual wallets typically interact with a small number of exchanges and peers. In contrast, team and project wallets frequently interact with specialized protocols to a greater extent. Their transactions go beyond traditional trades, involving complex processes like vesting, mass distribution, and staking rewards. These multifaceted interactions highlight the distinct roles that team and project wallets play in more complex and project-specific financial transactions.

Best Tools for Tracking Crypto Wallets

Transparency should be a prime concern when using blockchain technology. However, for ultimate transparency and to track your crypto transactions, there are plenty of tools available. Especially for investors who are interested in tracking their cryptocurrency transactions more frequently, some tools can help them track their wallets more efficiently. However, effective tracking is simply incomplete without the right tools. Therefore, here we have listed some of the best tools for trading cryptocurrencies.

For Ethereum-based wallets, Etherscan is a go-to blockchain explorer. It provides detailed information on transactions, token holdings, and smart contract interactions, offering a comprehensive view of Ethereum-based wallet activities. Additionally, it offers detailed information on ERC-20 and ERC-721 token transfers. It is primarily focused on the Ethereum blockchain, with limited support for other chains. However, it enables users to set up email alerts for specific addresses.

Dune Analytics has come up with more customized options for crypto users. It enables users to create custom dashboards that offer tailored insights about specific wallet activities. In addition, to robust analytics, it enables a high degree of flexibility in analyzing wallet data. However, it supports a variety of blockchain networks.

CertiK recently launched the Skynet for Community platform, which provides advanced tools for tracking and analyzing Web3 projects. In addition, it has a smart money wizard and a wallet analyzer dashboard. Wallet Analyzer makes on-chain research easier by collecting unstructured data and displaying key wallet characteristics, portfolio composition, wallet relationships, and trading activity. However, these features make it easy to track and analyze smart money, use Whale Wallets, and find new investment opportunities. You can view detailed information on total transactions, both incoming and outgoing. Additionally, you can also see the number of token types it holds and the wallet addresses associated with specific transactions.

Nansen provides institutional-grade research and data-driven insights into cryptocurrency, with a focus on assisting users in making sound investment decisions. Despite not being a free service, Nansen offers powerful tools and features that serious traders and investors may find useful. The platform provides detailed information on top wallets, including labeled addresses, as well as advanced tools for analyzing wallet activity and trends. However, the pricing structure may be prohibitively expensive for most retail users, especially those with limited investment options. Additionally, some users may find the platform overwhelming or unnecessary for their specific needs.

Whale Alert is a real-time tracker for large cryptocurrency transactions. It notifies users about significant movements in the market, making it a valuable tool for identifying whale activities and potential market shifts.

Why Keep Track of Crypto Wallets?

Tracking and analyzing crypto wallets provide valuable insights into various aspects of the cryptocurrency market. However, by analyzing these wallets, all the investors, researchers, and people interested in cryptocurrency can make more informed decisions. Here are some important takeaways you can get from monitoring these wallets:

Market Trends and Customer Interest:

Observing market trends and customer interest can provide insights into the market and influence investors. However, observing market trends and customer interest helps you make more informed decisions and identify potential market shifts.

Funding Flow:

Observing the funding flow between the two addresses provides you with information about the flow of capital within the cryptocurrency ecosystem. However, this can help crypto users understand how the crypto is transferred and stored in a network.

Token Utilization and Popularity:

When looking for cryptocurrency investment, look for its popularity and token utilization. However, monitoring the top wallets gives you a sense of which tokens are being transacted, or staked, by the top players. This information can assist you in identifying popular or emerging tokens that may warrant additional research or investment.

Network Performance:

The overall health and congestion of a blockchain network can be determined by analyzing transaction volumes and patterns. This data can help predict potential scalability issues or determine the best times to conduct transactions.

Risk and Security Assessment:

Tracking a cryptocurrency wallet can help you detect suspicious activity like scams, potential hacks, or fraudulent transactions. Furthermore, this will assist you in assessing security risks and alerting you to potential market risks.

Credibility of the Project and Team:

Analyzing the wallet activity of some project founders, developers, and team members provides you with insights into the project. However, these insights clarify the credibility and integrity of a project. For example, if a team is selling its tokens constantly, it might raise concerns about the project’s long-term viability.

Thus, tracking and analyzing crypto wallets is critical. However, it offers valuable insights into market trends, network health, and potential investment opportunities. Therefore, by staying informed about the behavior of influential players, you can make more informed decisions.

Identifying Smart Money Investors:

Smart money investors often leave a distinct footprint in the crypto space. Identifying these influential players and tracking their wallets can offer valuable insights. Look for patterns in their investment strategies, observe wallet movements during market fluctuations, and analyze their historical transactions. To identify smart money investors, focus on wallets associated with reputable individuals, institutional investors, or entities with a significant impact on the crypto market. Tracking their movements can help you make informed decisions and align your strategies with market trends.

1. Transaction Patterns:

Smart money investors often exhibit strategic transaction patterns, such as well-timed entries and exits. Analyzing the frequency and size of their transactions can provide insights into their market intelligence.

2. Researching Wallet Holdings:

Some investors with significant holdings are considered “smart money.” Therefore, identify the wallets with high balances to investigate their transaction histories. Additionally, keep an eye on wallets associated with institutions, as their transactions can have a substantial impact on the market. Institutional wallet addresses are often publicly available.

3. On-Chain Analytics:

Utilize on-chain analytics tools to track large transactions and movements of funds. Smart money is likely associated with significant transfers and activities that impact the market.

4. Participation in ICOs and Token Sales:

Smart money investors frequently invest in Initial Coin Offerings (ICOs) or token sales for promising projects. Monitoring their participation in such fundraising events can reveal strategic investment decisions.

5. Social-Media and News Monitoring:

Smart money investors may share insights or hints about their positions on social media or during interviews. Monitoring reputable financial news sources can reveal their thoughts and strategies.

6. Network Connections:

Smart money investors often have connections with other influential players in the industry. Thus, exploring their network connections can provide a broader understanding of their standing within the crypto community.

7. Long-Term Investment Approach:

Smart money investors typically adopt a long-term investment horizon. Identifying wallets with a history of holding assets over time rather than engaging in frequent trades may indicate a strategic approach.

8. Track Record:

Assessing a wallet’s historical performance by examining past trades and investment decisions can help gauge the investor’s track record and proficiency in making strategic moves. Remember, while these indicators can be useful, no single factor guarantees that an investor is “smart money.” A comprehensive examination of multiple aspects is required for a more accurate assessment.

Bottom Line:

Hopefully, your search for how to track a crypto wallet has been completed thoroughly. However, tracking a crypto wallet requires a strategic approach, leveraging both traditional and innovative tools. Thus, choosing the right wallet to monitor, understanding blockchain exploration, and locating relevant wallets can help. Furthermore, identifying smart money investors and using the best tools, such as PlasBit, can assist you in positioning cryptocurrency in the appropriate domain.

Leave a Reply